Professional overhead expense (POE) insurance works with the disability insurance benefit – if you are disabled, POE will cover your overhead and business expenses for a period of time until you can return to practice or for that same period of time if you cannot.

The definition of total disability for POE insurance is the same as that of the disability benefit:

- unable to perform the essential duties of your regular occupation due to illness or injury

- under the regular care of a physician

- not gainfully engaged in any other occupation

A partial disability benefit is also included in the POE coverage; the benefit received would be based on the percentage of lost monthly income due to the disability.

POE insurance should be considered by those practicing physicians who would still have to contribute to clinic/practice expenses even if they could not practice due to a disability.

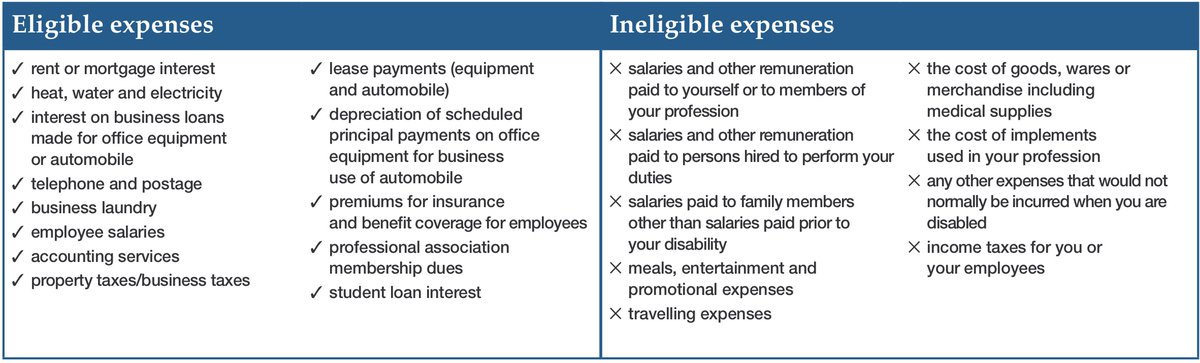

The following table illustrates the type of business expenses that would and would not be covered.

POE is a monthly reimbursement while you are disabled to keep your practice running smoothly by covering expenses and protecting your business assets. The coverage is purchased as a monthly benefit with a maximum of $20,000/month and a 14-day or 30-day elimination period (the number of days a claimant would wait until the monthly benefit would begin). POE benefits will never exceed the average monthly amount of covered monthly overhead expenses during the six months preceding the disability.

The total benefit received is capped at 12 times the monthly insured benefit and the benefit can be rolled over for up to 36 months until the maximum is reached. For example, at $5,000/month, the claimant would have up 36 months to claim to a maximum of $60,000; if the maximum is reached before the end of 36 months, the claim is closed and the benefit ends.

For those claimants age 70 or older, the maximum drops to 12 months from 36 (POE coverage is in force until age 80).

As with the disability coverage, the guaranteed insurability benefit (GIB) rider can also be attached to the POE benefit. It will allow you to increase your POE benefit in April each year, without proof of good health, to up to $2,000/month for those under the age of 40 or $1,000/month for those over the age of 40. The POE GIB rider terminates at age 60.

If an insured is totally disabled for a period of at least 90 consecutive days and is receiving disability benefits, Sun Life will waive the POE premium.

If, after six months of receiving disability benefits, you return to your regular occupation full time, you may receive up to 50% of your previous month’s POE benefit in your first month after returning to practice.

A recurrent disability benefit is also included whereby, if the claimant suffers the same disability within six months of the last claim ending, POE benefits will resume without having to re-satisfy the waiting period.

If you became totally disabled as a result of cosmetic surgery or the transplant of a part of the body to the body of another, POE benefits may also be payable.

A parental benefit is also included with the POE coverage – if you have been enrolled in the POE plan for at least 12 months prior to the birth or adoption of the child and are on full-time leave from your practice, you would be eligible.

- The parental benefits are payable no earlier than eight weeks before the delivery date and end no later than 17 weeks after delivery.

- Benefits would be the lesser of 50% of the monthly POE benefit or the current employment insurance (EI) monthly benefit.

- The parental benefit will not exceed the amount of covered monthly overhead expenses actually incurred.

- If a disability occurs during or after pregnancy, benefits will be paid as provided under the partial or total disability benefit provisions.

- Multiple births or adoptions do not change the level of parental benefit.

To receive more information on POE insurance, our members in northern Alberta (Red Deer, north) can contact me at 780.482.0306 or kelly.guest@albertadoctors.org. Our members in southern Alberta can contact Mona Yam at 403.205.2088 or mona.yam@albertadoctors.org.

Banner photo credit: Steve Buissinne, Pixabay.com