The registered retirement savings plan (RRSP) season is upon us — from now until March 1, you’ll see messages encouraging you to contribute to your RRSP before the deadline.

An RRSP helps you save for retirement by giving you a tax deduction when you contribute. Then the money inside your RRSP grows tax-deferred until you’re ready to make withdrawals. Remember, though, that you need to pay yourself a salary (versus dividends) to create RRSP contribution room.

If you’re a physician with a medical professional corporation, you may have a combination of options that allow you to save for retirement outside an RRSP, such as a tax-free savings account (TFSA), government pension plans, a corporate individual pension plan, and corporate withdrawals (dividends).

Many physicians incorporate their medical practice to reduce taxes and save more for retirement. In the past, some tax experts may have advised keeping any and all earnings that weren’t needed right away inside the corporation, rather than an RRSP or TFSA. That’s because a professional corporation can provide a way to reduce taxes on earnings in any given year.

So, should you contribute to your RRSP?

How much tax will you save with your RRSP contribution?

With RRSPs, physicians are subject to the same limit-determining formula and maximums as all other Canadians. These limits are based on personally earned income. If you’re an incorporated physician, for instance, and you bill $300,000 but pay yourself $60,000 personally, the RRSP limit is based on your personally earned income of $60,000.

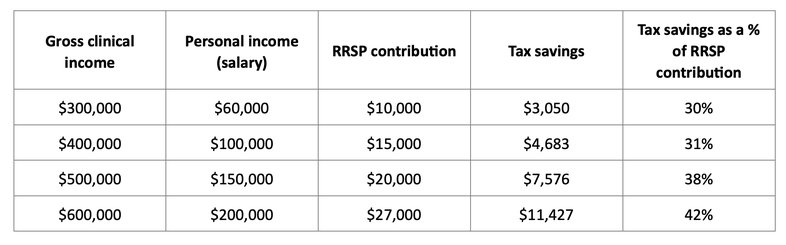

Since a contribution to an RRSP yields a tax deduction, the value of making a contribution is based on your personal income and marginal tax rate. Here are some examples for a physician in Alberta.

What should you consider before making an RRSP contribution?

Reduced billings

If your billings as an incorporated physician were reduced in 2021 and you paid yourself less than usual, the tax-deduction value of your RRSP contribution may also be reduced, given that the value of your contribution depends on your marginal tax rate.

You may want to consider not making a full RRSP contribution for 2021, and instead carrying forward some of your contribution room to a year when you’ll earn more income. Remember that your contribution limit for a given tax year is based on the previous year’s income. That means lower billings in 2021 will affect your contribution room for the 2022 tax year.

Rather than contributing the full allowable limit to an RRSP for 2021, it might make sense to focus on other retirement savings strategies, such as leaving money in the corporation or contributing more to your TFSA.

Passive income rules

On the other hand, you may be affected by the passive income rules, which took effect on January 1, 2019. In a nutshell, these rules mean that if you have too much passive income from your corporate portfolio, your access to the small business tax rate on your net professional income could be reduced. To learn more, see Passive income rules and tax rates for incorporated physicians.

If you are affected by the passive income limits, paying yourself a salary and contributing to your RRSP can help mitigate the impact. You can use your RRSP as a savings vehicle — one where the investments grow tax-deferred until it’s time to make withdrawals. This way, the portion of your investments that creates passive income goes down, while your total investments remain the same or even go up. Another benefit of paying yourself a salary is that it reduces the corporation’s net practice income.

Your accountant is in the best position to advise you on how much salary to take from your practice income. Your MD Advisor* can help you determine how to manage your corporation’s passive income and how to strike the right balance between corporate investments and RRSP contributions.

There’s no one-size-fits-all answer, and you still have some time to decide — the 2021 RRSP deadline is March 1, 2022. Talk to your Advisor about your optimal contribution strategy.

* MD Advisor refers to an MD Management Limited Financial Consultant or Investment Advisor (in Quebec), or an MD Private Investment Counsel Portfolio Manager.

The information contained in this document is not intended to offer foreign or domestic taxation, legal, accounting or similar professional advice, nor is it intended to replace the advice of independent tax, accounting or legal professionals. Incorporation guidance is limited to asset allocation and integrating corporate entities into financial plans and wealth strategies. Any tax-related information is applicable to Canadian residents only and is in accordance with current Canadian tax law including judicial and administrative interpretation. The information and strategies presented here may not be suitable for U.S. persons (citizens, residents or green card holders) or non-residents of Canada, or for situations involving such individuals. Employees of the MD Group of Companies are not authorized to make any determination of a client’s U.S. status or tax filing obligations, whether foreign or domestic. The MD ExO® service provides financial products and guidance to clients, delivered through the MD Group of Companies (MD Financial Management Inc., MD Management Limited, MD Private Trust Company, MD Life Insurance Company and MD Insurance Agency Limited). For a detailed list of these companies, visit md.ca. MD Financial Management provides financial products and services, the MD Family of Funds and investment counselling services through the MD Group of Companies. MD Financial Management and Scotiabank are proud sponsors of the AMA Youth Run Club.

Banner image credit: Franz W Pixabay.com