Did you provide phone or virtual care to your patients last year due to the pandemic? You may be entitled to some additional tax savings for working from home. How much and what expenses you can deduct are determined by your employment status: employee or self-employed (unincorporated or incorporated).

You’re an employee

If you worked from home in 2021, you can deduct home office expenses from your taxable income using one of two approaches: the flat-rate method or the detailed method. The most you can deduct from the flat-rate method is $500, whereas the detailed method lets you deduct a portion of your actual expenses.

Flat-rate method

If you worked from home more than 50% of the time over at least four consecutive weeks, you can deduct $2 for each day worked from home (not limited to the four-week period), up to a maximum of $500. You do not need to provide receipts for expenses incurred.

Detailed method

To make a claim based on the actual home office expenses you paid, you will need a signed Form T2200 or T2200S, a simplified version created for the pandemic.

On the T2200 or T2200S, your employer validates the terms of your employment to confirm, among other things, that you use a portion of your home for work. Generally, this means that you need to have used your home office space more than 50% of the time for at least four consecutive weeks in 2021.

You will need your employer to provide you with a copy of the T2200 or T2200S. You will then be able to claim employment expenses on your tax return using either Form T777 (Statement of Employment Expenses) or T777S, the simplified pandemic-specific version.

You can claim a portion of the following expenses:

- electricity, heat and water bills

- office supplies (not equipment)

- rent

- home internet service

- maintenance expenses, but only if they were solely for your workspace. For example, if you painted your entire house, you can’t deduct any of that. But if you just painted your workspace, you can deduct most or all of that.

Note that as an employee, you can deduct rent, but you cannot deduct mortgage interest, property tax, insurance or any capital costs (equipment).

A common way to determine the pro-rated portion of your expenses is to estimate the area of your workspace as a percentage of the total finished area of your home.

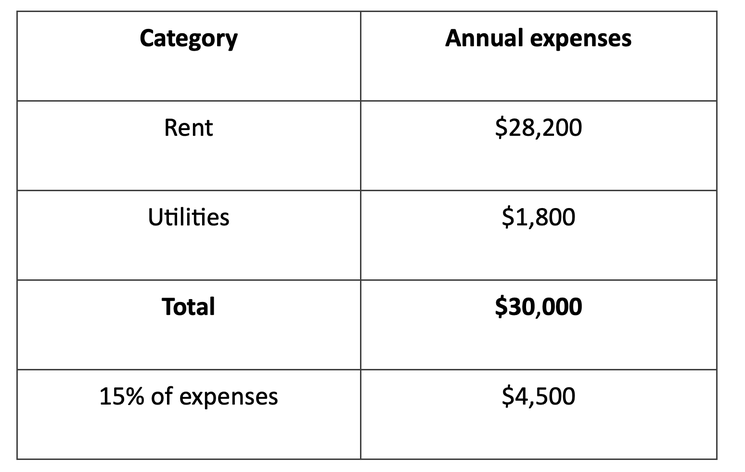

Say you’re renting a 1,000-square-foot condo and your home office takes up 150 square feet, or 15% of the total area. Your annual expenses for utilities, internet, rent, and so forth are $30,000. Since your home office is 15% of the total space, you can deduct 15% of the expenses — or $4,500 — from your employment income. Depending on your tax bracket, this could save you up to 50% of that amount — or $2,250 — in taxes.

If you don’t have a dedicated workspace — if, for example, you work on your dining room table — you can deduct expenses only for the time the room was used as a home office. If you use the dining room table for work only 50% of the time, you can deduct only 50% of the expenses for the space.

You’re self-employed but unincorporated

If you’re self-employed, you can deduct business-use-of-home expenses to the extent that they’ve been incurred to earn business income.

Use Form T2125 (Statement of Business or Professional Activities) to report all revenues and expenses related to your professional activities. You can deduct a portion of the following under business-use-of-home expenses:

- heat, electricity

- insurance

- maintenance

- mortgage interest

- property tax

- other expenses (you need to specify)

To calculate how much to deduct, add up all your home office expenses and pro-rate them. A reasonable method is to figure out the proportion of the total finished square footage of your home that you use for business and use that same proportion of your total home office expenses.

If you use part of your home for both your business and personal living, calculate how many hours in the day you use the rooms for your business, and then divide that amount by 24 hours to determine the portion related to the household.

Note that, unlike an employee, you can deduct the business portion of your mortgage interest, property tax and insurance.

You’re self-employed and incorporated

If you’re incorporated, you can do one of two things:

- The corporation can pay you rent for using your space, and the corporation deducts the rent as part of its overhead expenses. If you are personally charging rent to the company, this would be taxable income to you personally. However, you would then be able to deduct rental expenses to offset the rental income.

- If you pay yourself a salary, you can deduct your home office expenses as an employee on your personal tax return using Form T777 (Statement of Employment Expenses) or T777S (the simplified pandemic version) if you meet the eligibility requirements.

It is probably better to charge rent to the corporation since the business itself could deduct more expenses, e.g., property taxes, insurance, etc. There are also fewer restrictions on eligibility compared with deducting home office expenses as an employee.

Keep track of your expenses

Please note that the flat-rate method for employees is a temporary measure that has been extended for 2022. Be sure to keep track of any expenses that you incur while working remotely this year in case the Canada Revenue Agency wants to see them.

Your accountant can help you claim these expenses. If you have any questions about financial planning, contact your MD Advisor*.

Notes:

*MD Advisor refers to an MD Management Limited Financial Consultant or Investment Advisor (in Quebec), or an MD Private Investment Counsel Portfolio Manager.

MD Financial Management provides financial products and services, the MD Family of Funds and investment counselling services through the MD Group of Companies and Scotia Wealth Insurance Services Inc. For a detailed list of the MD Group of Companies visit md.ca and visit scotiawealthmanagement.com for more information on Scotia Wealth Insurance Services Inc. MD Financial Management is a proud sponsor of the AMA Youth Run Club.

Banner image credit: Roberto Nickson unsplash